how long can the irs legally collect back taxes

After this 10-year period or statute of limitations has expired the. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

There is a statute of limitations on collection of taxes and it is generally 10 years.

. But the agency cant chase you forever. 6502 a limit is placed on how long the IRS can pursue unpaid taxes from an individual. How far back can the IRS collect unpaid taxes.

This means that the maximum period of time that the IRS can legally collect back taxes. IRC 6161 allows an extension to pay estate. 485 51 votes Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

The IRS 10 year window to collect. The IRS generally has 10 years from the date of assessment to collect on a balance due. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

After that the debt is wiped clean from its books and the IRS writes it off. The tax assessment date can change. As stated before the IRS can legally collect.

Make IRSgov your first stop for your tax needs. The Internal Revenue Service IRS has a 10 year statute of limitations for which they can collect back taxes. As already hinted at the statute of limitations on IRS debt is 10 years.

For the IRS the time limit is only 10 years. This is known as the statute of limitations. This means that the maximum period of time the IRS can legally collect on back.

Learn more about the IRS Statute of Limitations here. GET PEACE OF MIND. The collection statute expiration ends the.

IRM 557 Collecting Estate and Gift Tax Accounts provides additional information on collection of estate tax accounts and the CSED. IRC Section 6502 provides that the length of the period for collection after assessment of a tax liability is 10 years. Once that time expires you are free from the remaining unpaid tax debt and the IRS cannot.

The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you. The Internal Revenue Service the IRS has ten years to collect any debt. For most cases the IRS has 3 years from the date the return was filed to audit a tax return and determine if additional tax is due.

This means that under normal circumstances the IRS can no longer pursue collections action against you if. The IRS generally has 10 years from the date of assessment to collect on a. According to Internal Revenue Code Sec.

As stated before the IRS can legally collect for up. Failing to pay your taxes may lead to IRS collection activities. With the Interactive Tax Assistant at IRSgovITA.

Please dont hesitate to contact us with any questions you may have. That statute runs from the date of the assessment. You can find answers.

Assessment is not necessarily the reporting date or the date on. After the IRS determines that additional taxes are. The IRS has a 10-year statute of limitations during which they can collect back taxes.

I Owe The Irs Back Taxes Help J M Sells Law Ltd

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

Haven T Filed Taxes In 1 2 3 5 Or 10 Years Impact By Year

How Far Back Can The Irs Audit Bench Accounting

What Is The Irs Statute Of Limitations On Collecting Tax Debt Atlanta Tax Lawyers

Are There Statute Of Limitations For Irs Collections Brotman Law

Can The Irs Take Your Social Security Check For Back Taxes

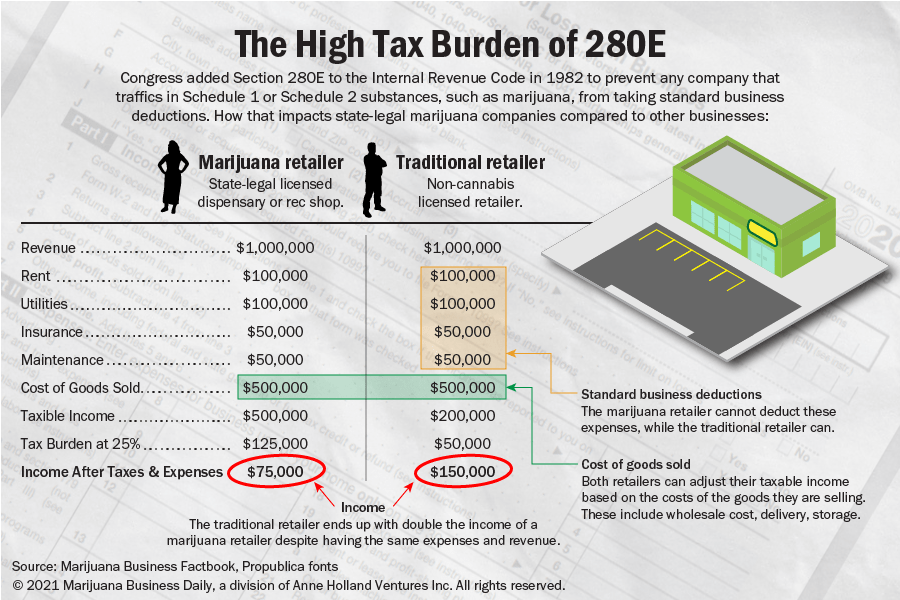

Newly Released Irs Documents Detail Effort To Collect Taxes From Marijuana Companies Under 280e

Get Rid Of Tax Problems Stop Irs Collections

Does The Irs Forgive Tax Debt After 10 Years Heartland Tax Solutions

How Long Can The Irs Collect Back Taxes Dollars Plus Sense

How Far Back Can The Irs Audit You New 2022

Why Can T The Irs Just Send Americans A Refund Or A Bill

What Happens To Federal Income Tax Debt If The Person Who Owes It Dies

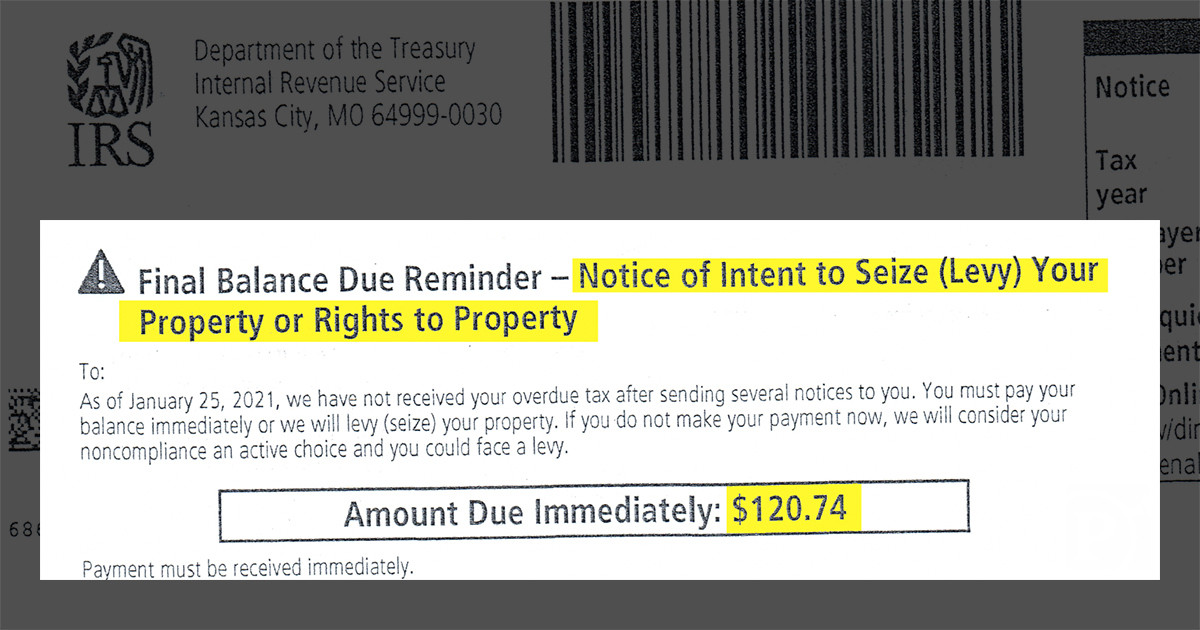

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Video Can A Collection Agency Claim My Tax Refund From The Irs Turbotax Tax Tips Videos

The Irs Cashed Her Check Then The Late Notices Started Coming Propublica

:max_bytes(150000):strip_icc()/mature-couple-calculating-home-finances-506033706-5bd22c53c9e77c00585cc074.jpg)